The Evolution and Current Landscape of Crime Reporting Trends

When it comes to crime analysis, there’s a lot of power in immediacy. Mostly, people are concerned about crime risk NOW. They’re interested to know the current crime trends, which is understandable, as that is what affects most people day-to-day. However, determining current crime trends isn’t as easy as scoping out news headlines – getting ahold of accurate and timely crime data is challenging. To understand why, let’s look at the evolution of crime reporting in the U.S.

The Evolution of Crime Reporting Trends

When examining crime and crime trends in the United States, experts and novices alike generally look to the FBI, the agency which has long been the clearinghouse for crime data. In 1930, the FBI initiated the Uniform Crime Reporting (UCR) program, the first nationwide effort to collect and report crime statistics in the United States. This program relied on the Summary Reporting System (SRS), which aggregated data on major crimes from participating law enforcement agencies. The SRS focused on eight Part I offenses (violent crimes including homicide, rape, robbery, and aggravated assaults, and property crimes including burglary, larceny-theft, motor vehicle theft, and arson), providing a basic overview of crime trends. However, the SRS had significant limitations, such as a lack of detailed information about each incident and only recording the most serious offense in a multi-offense incident. As the saying goes, “the devil is in the details” and the UCR lacked many important details.

long been the clearinghouse for crime data. In 1930, the FBI initiated the Uniform Crime Reporting (UCR) program, the first nationwide effort to collect and report crime statistics in the United States. This program relied on the Summary Reporting System (SRS), which aggregated data on major crimes from participating law enforcement agencies. The SRS focused on eight Part I offenses (violent crimes including homicide, rape, robbery, and aggravated assaults, and property crimes including burglary, larceny-theft, motor vehicle theft, and arson), providing a basic overview of crime trends. However, the SRS had significant limitations, such as a lack of detailed information about each incident and only recording the most serious offense in a multi-offense incident. As the saying goes, “the devil is in the details” and the UCR lacked many important details.

In response to these limitations, the FBI developed and implemented the National Incident-Based Reporting System (NIBRS) in the 1980s. Unlike the SRS, NIBRS collects data on each crime offense, offering a richer dataset with detailed information about the nature of the offense, the characteristics of victims and offenders, and the circumstances surrounding the crime. NIBRS records more data elements, encompassing a broader range of crimes beyond the eight Part I offenses, including white-collar crimes, drug offenses, and many other property crimes. The shift to NIBRS marked a significant evolution in crime reporting, enabling more nuanced analyses and better-informed law enforcement strategies.

Over time, the transition to NIBRS has continued, with more agencies adopting this system for crime reporting to enhance the accuracy and depth of crime data across the nation. In 2015, many of the larger law enforcement associations (e.g., IACP, MCC, NSA, MCSA) drafted a letter of support for law enforcement agencies aiming to modernize their crime reporting through the adoption of NIBRS. This led to the FBI and Bureau of Justice Statistics investing over $100M between 2015 and 2021 to assist agencies in adopting NIBRS.

The FBI mandated a complete transition from SRS to NIBRS by January 1, 2021, reflecting a nationwide effort to modernize crime reporting and provide a more detailed and comprehensive picture of crime in the United States. However, even though NIBRS has been around for decades, its adoption by law enforcement agencies has been limited for several reasons: first, agencies must go through a certification process, and second, law enforcement agencies need to upgrade their Records Management Systems (RMS) which is a costly endeavor.

By the time SRS was switched off in 2021 with the transition to NIBRS, crime reporting experienced a significant drop in agency participation with fewer than 12,000 (about 63%) of agencies in the United States providing data vs 16,000 (89%) participating in UCR-SRS.

By the time SRS was switched off in 2021 with the transition to NIBRS, crime reporting experienced a significant drop in agency participation with fewer than 12,000 (about 63%) of agencies in the United States providing data vs 16,000 (89%) participating in UCR-SRS.

Of course, it will take years of growth to achieve the same level of crime reporting in NIBRS as was seen with the SRS. Although the NIBRS data progression is a step in the right direction, there continues to be a lag in data availability. In short, we won’t see 2023 crime numbers for the US at large until around October 2024. This temporal lag in data availability undermines our ability to understand ‘current’ crime trends. The FBI does make available a coverage map of participating agencies in 2022 and the Bureau of Justice Statistics developed a data visualization portal, LEARCAT.

To further ease these issues, the FBI has recently provided quarterly crime updates that give a snapshot into emerging trends. Data for Q1 of 2024 was made available mid-June and includes information from about 71% of law enforcement agencies in the nation. Interestingly, in the quarterly reports, the FBI takes the NIBRS data and makes available the traditional SRS crime types in these quarterly reports, providing some degree of comparison to past data releases.

Curren t Crime Trends by Crime Type – FBI & NIBRS

t Crime Trends by Crime Type – FBI & NIBRS

The FBI’s 2024 Quarterly UCR website provides crime reporting data, albeit limited, to understand current and emerging crime trends. Users can select specific crime types which can be separated based on jurisdictional population and region of the nation. Again, the information is limited but it does offer useful crime reporting data reporting for understanding current trends. Using available FBI data for Q1, here are some observations on what we’re seeing so far in 2024.

Violent Crime: As a whole, violent crime is down 15% in Q1 2024 compared to Q1 2023. For example, aggravated assault is down 12% in Q1 2024 versus 2023, with the largest decline being seen by agencies in the south who are reporting a 17% reduction in the region.

Property Crime: Aggregated to include the four property crime types, there is an overall reduction of property crime by 15% with some important regional differences. Though larceny-theft increased in the Northeast by 9%, all other regions reported reductions (Midwest 21%, South 13%, and West 15%).

The Quarterly UCR is a step in the right direction in terms of overcoming the lag in crime data. Although these updates are limited in what crime characteristics are made available, and they basically only show percent changes for population and region for a subset of crime types, something is better than nothing. By the time the full NIBRS dataset for 2023 is released, it will be closer to 2025, making it difficult to speak to current trends when most of the data are over a year old.

Crime Trends by Location Category

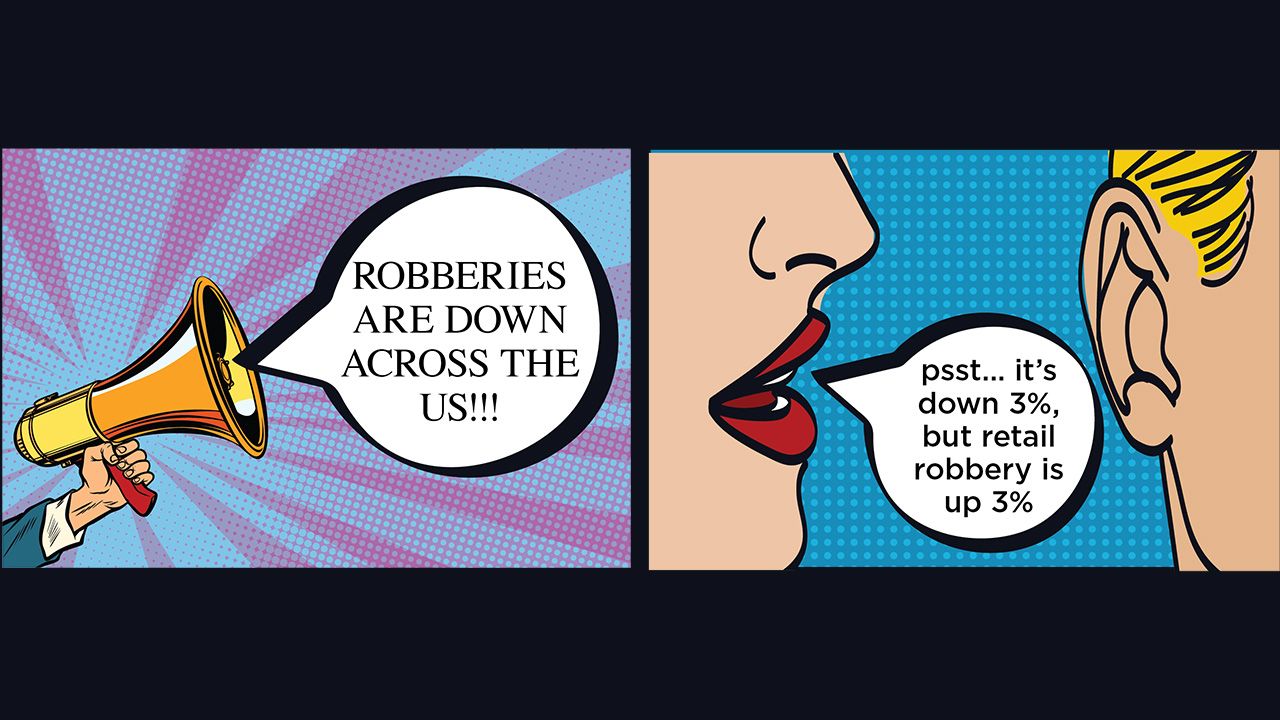

To stay on top of current crime trends, CAP’s Research and Innovation team collects data from cities across the United States that share their crime data online and include rich NIBRS characteristics: specifically, we focus on cities that provide the location category associated with an incident. So, whereas the UCR and the Quarterly updates speak generally to whether robbery is increasing or decreasing overall, they cannot identify whether those robberies are occurring at retail locations or financial institutions and the information is too general to be of benefit to most businesses. In contrast, the crime information CAP collects and analyzes includes specific location categories and means we can better understand current crime trends.

Again, worth reiterating, these are crimes known to police, so reported crimes. The discussion below does not delve into those crimes not reported to police, known as the ‘dark figure’ of crime.

Note: Data are collected from 16 cities that include the location category. Through Q2 of 2024, only 14 of the 16 cities have fully updated data that we can use for the discussion below. For instance, New York City typically takes longer to update their online crime data, creating a lag in what is publicly available immediately following the end of a quarter. These data are made available, just at a different time.

In the first half of 2024, we are seeing decreases in both violent, person crimes (12%) and property crimes (6%). For instance, decreases occurred across specific crime types: aggravated assault 10%, homicide 20%, robbery 9%, motor vehicle theft 9%, and larceny/theft 4%. An interesting contrast to these numbers is that destruction of property/vandalism, a crime against society, has increased 4% when compared to the first half of 2023. The ability to see this nuance is a perk of our approach because we can select our specific location categories to identify if similar patterns remain consistent across locations.

- Retail: Looking at retail locations, crime is up 7% the first half of 2024 compared to 2023, with larceny/theft driving much of the increase (up 12%).

- Department Discount: Larceny/Theft is up 19%.

- Grocery/Supermarket: Larceny/Theft is up 12%.

- Hotel/Motel: For Hotels/Motels, crime is down 2% so far in 2024. Initially, in Q1 of 2024, Hotels/Motels did experience a 4% increase in property crime but this was followed by a 7% decrease in Q2. Violence/Person crimes decreased in both Q1 and Q2, leading to an overall reduction of about 21% in violent/person crimes for the first half of 2024.

- Healthcare: Similar to the general experience across the measured cities, crime occurring specifically at health-related locations has decreased in 2024. This includes both property and violent crimes.

- Financial: The uniqueness of NIBRS location categories separates banks and ATMs from other institutions. Over the first half of 2024, banks are experiencing an overall reduction in crime (around 20%), while crime at ATMs has increased in the first half of 2024. The crime increase at ATMs occurred in Q1 2024, with increases up 43% compared to Q1 2023. This substantial increase was followed by a reduction in Q2 2024.

- Street: In general, street crimes are down 9% overall, including crimes against society. Street property crimes are down 15% and street persons crimes are down 22%. Specifically, street robbery is down 20% for the first half of 2024. Even the significant increase in motor vehicle theft in 2023 is being offset by a reduction in the first half of 2024, currently down 15%.

- Residential: Violent and property crime are down for the first half of 2024 (15% and 10% respectively). Residential burglary is down 14% in 2024 with aggravated assault also down 11%.

Conclusion

In conclusion, understanding Crime Reporting Trends in the United States requires recognizing the transition from the UCR to the more detailed NIBRS system. While the shift has provided richer data and more nuanced insights, challenges remain in achieving comprehensive and timely reporting. As the adoption of NIBRS continues to grow, it holds promise for more accurate crime analysis and better-informed law enforcement strategies, ultimately enhancing our ability to respond to and prevent crime effectively.

References

- FBI. (2015, August 26). Multi-Agency Letter in Support of the NIBRS Transition. UCR Home. https://www.fbi.gov/file-repository/ucr/nibrs-joint-seal-letter-of-support-august-2015.pdf/view

- FBI. (2017, Fall). NIBRS, 2016. Federal Bureau of Investigation. https://ucr.fbi.gov/nibrs/2016/resource-pages/benefits-of-nibrs-participation-2016_final.pdf

- FBI. (2018a, December 21). NIBRS 101. Federal Bureau of Investigation. https://www.fbi.gov/video-repository/nibrs-101.mp4/view#:~:text=It%20was%20originally%20produced%20by,Crime%20Reporting%20Program%2C%20or%20UCR

- FBI. (2018b, July 10). FBI Letter on NIBRS Transition. UCR Home. https://www.fbi.gov/file-repository/ucr/fbi-letter-on-nibrs-transition-071018.pdf/view

- FBI. (2002, May). Handbook for Acquiring a Records Management System (RMS) that is Compatible with the National Incident-Based Reporting System (NIBRS). Federal Bureau of Investigation. https://ucr.fbi.gov/nibrs/nibrshandbook_rms.pdf

RELATED CONTENT

ARTICLE

PLACE MATTERS: UNDERSTANDING TRUE CRIME RATES

In their May 2024 “Ask the Expert” feature in Loss Prevention Magazine, Dr. Grant Drawve and Walter Palmer of CAP Index discuss the nuanced interpretation of crime data, emphasizing the importance of understanding true crime rates, the role of location in crime trends, and the application of data and modeling to improve operations, lower risks, and allocate resources effectively.

ARTICLE

LOOKING BACK: KEY FACTORS IMPACTING CRIME TRENDS

Crime isn’t static, and CAP Index updates its database annually with over 200 million data points, analyzing crime trends influenced by societal changes, police staffing shortages, and richer datasets, ensuring businesses receive accurate local crime risk assessments and can confidently make key security decisions.

ARTICLE

CUTTING THROUGH THE HYPE: FINDING THE REAL CRIME DATA

Dr. Grant Drawve and Walter Palmer of CAP Index discuss in Loss Prevention Magazine how to critically analyze crime data and headlines, emphasizing the importance of granular, neighborhood-level insights over broad national or city-wide statistics to effectively improve operations, lower risks, and allocate resources.

Sample CRIMECAST Reports

Sample CRIMECAST Reports